How Much Does It Cost to Raise a Child?

You can’t put a price on family, but we all know that having kids does not come cheap. In fact, a recent report found that 59% of millennial parents underestimate the cost of raising children. So, how much does it really cost to have kids?

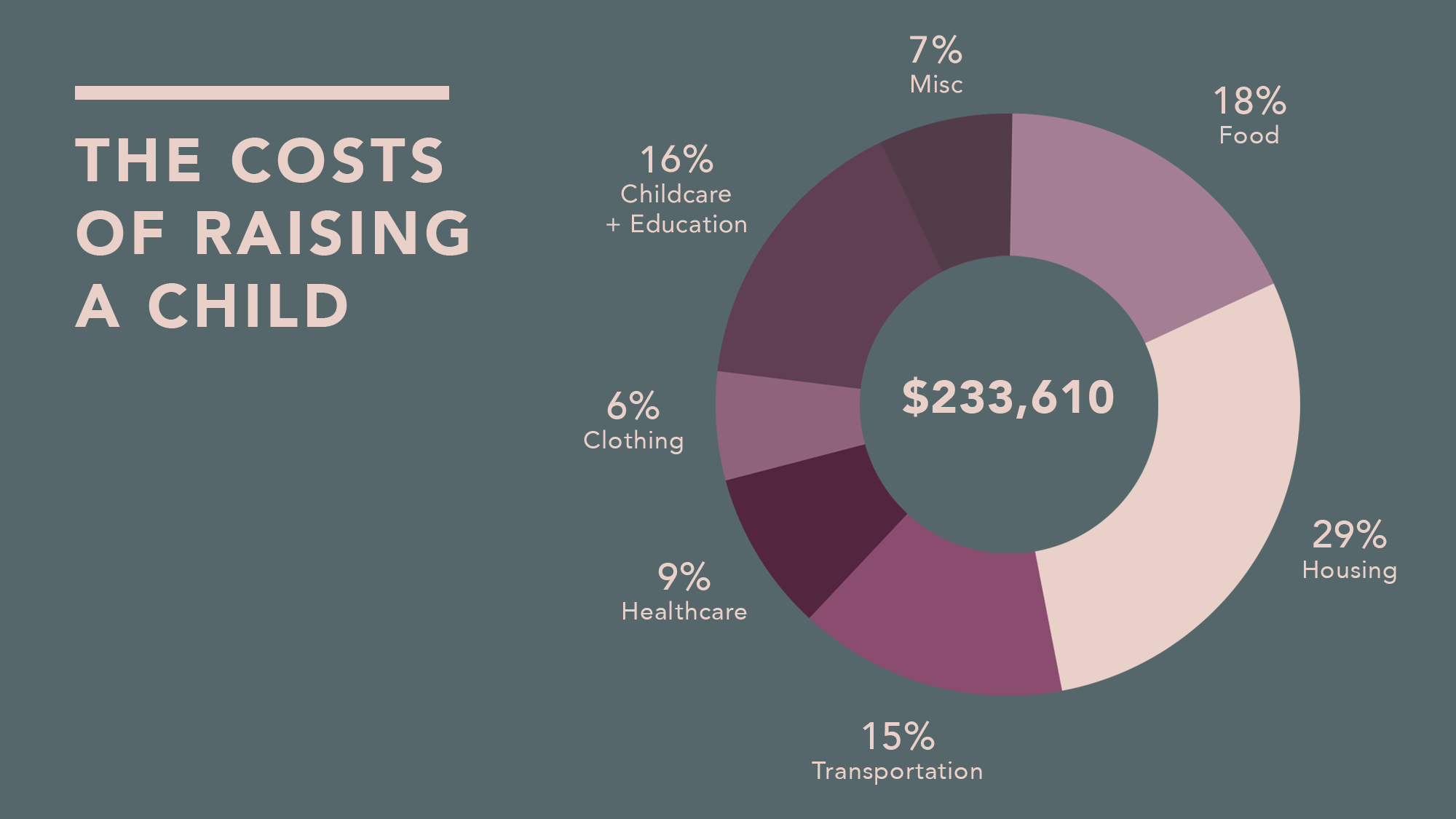

The most recent USDA report estimates an average of $233,610 to raise a child from birth to the age of 17. While this figure is based on expenditures from middle-income, married-couples, and will differ for each family, it highlights just how expensive raising a child can be. By the way, this total was calculated 2015 expense data. So in reality, the cost of raising a child in 2020 is even higher. Moreover, this figure does not account for pre/post-natal care, fertility care, childbirth and adoption costs. Before a child even arrives, the costs can rack up significantly.

Here is a percentage breakdown of the different expenses of raising a child, as calculated by the USDA:

The cost of food, clothing and other necessities will fluctuate between households with different income levels and composition. Naturally, middle and high-income parents are able to spend more on nonessentials, meaning their overall expenses are much higher than those of lower-income families. As a result, it’s impossible to determine a magic number that everyone should expect to spend when raising a child. However, there are certain financial factors that apply to every family.

Here are 4 things that all parents should consider when financially planning for kids:

Expenses increase as a child ages. Teenagers cost the most to feed and typically have higher non essential expenses . Moreover, the USDA average does not account for college tuition fees, which are notoriously expensive. Kids only get more expensive as they get older!

The cost of raising a child is hugely dependent on the region you live in. Typically, families who live in urban areas spend more, while those in more rural regions spend less. Families in the urban Northeast spend the most; the average cost of daycare is estimated at $20,415 in Massachusetts. Comparatively, child-rearing expenses are 27% lower in the Midwest and rural areas.

Utility bills and health insurance are small but significant expenses that are often overlooked. Spending more time at home will inevitably drive up household expenses. Moreover, families who need to move to a larger home will incur even larger expenses than those who don’t.

Taking time off work with the arrival of a baby will cost parents. Indirect expenses such as time costs, foregone earnings, and a pause on career progression all contribute to the overall expense of raising a child. Anticipate the loss of earnings by arranging an emergency fund or by taking advantage of benefit packages. We discuss some pre-tax saving options in our previous article on Flexible Savings Accounts.

The bottom line: children are expensive. Starting a family is a huge financial responsibility. This is not just a big, one-time expense, but rather, starting a family has costs that increase over time. Family finance is an overwhelming topic that affects every current and aspiring parent, but it should not eclipse the immeasurable joy and fulfilment that comes with starting a family. Which is why we’re here to help guide you through it all. We’re here to help you handle the un-fun, un-fulfilling portions, so you can focus on the thrills and joys in your life. If you missed our previous posts, we’ve already covered some basics on personal finance, specifically on Stuff We Wish We Learned at School and saving for Big Ticket Items.

Ultimately, we’re focused on empowering individuals to plan for bright futures, and being financially prepared is an essential part of that.